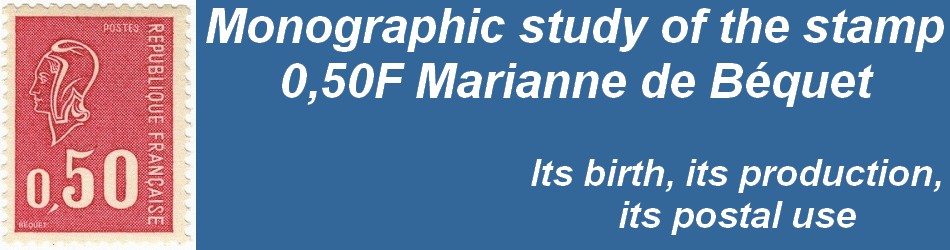

Introduction

A mail tax can intervene in two different circumstances: the occurrence of a penalty or the justification for a provided service.

Penalties are associated with the following events:

- The insufficiency of postage or the non postage of a standard domestic letter, that comes from France or from a foreign country or is sent to France or to a foreign country;

- The resending of a registered or a in value declared object;

- An abuse of franking sending;

- The single tax of an administrative mail.

Taxes justify a service provided in the following cases:

* The collection of receipts and other commercial values by post;

* The claiming tax;

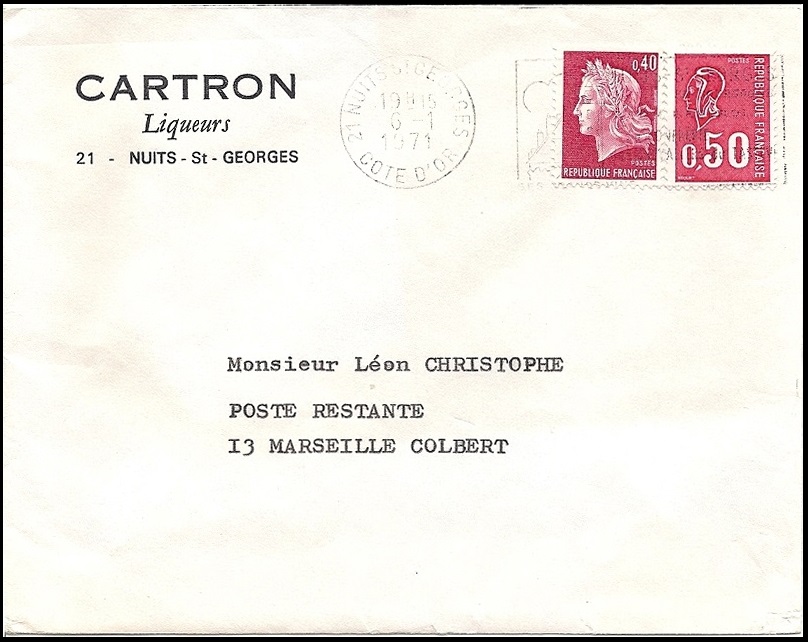

* Poste Restante;

* Customs.

Taxation for the occurence of a penalty

Taxation for insufficiency of postage

The case of domestic mail

For the validity period of the Marianne de Béquet stamp, the tax is equal to the double of the insufficiency of postage, with a minimum tax (cf. Table below):

We can see that the minimum tax is lower for newspapers than for other objects. It should be noted that since the introduction of the two-tier postal service in January 13th, 1969, letters are taxed with regard to the non-urgent mail rate, except in cases where the sender explicitly mentioned the urgent nature of his sending by the mention "LETTRE".

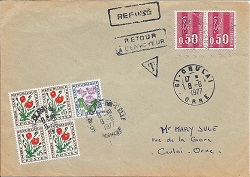

The amount of the tax must be paid by the addressee, unless in the case of a refusal by the latter, in which case the mail is returned to the sender.

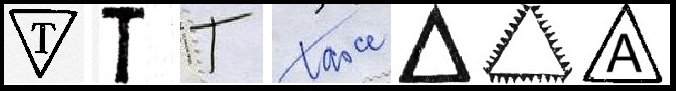

On taxed letters, various marks affixed by the postman can be found, some of which are shown below:

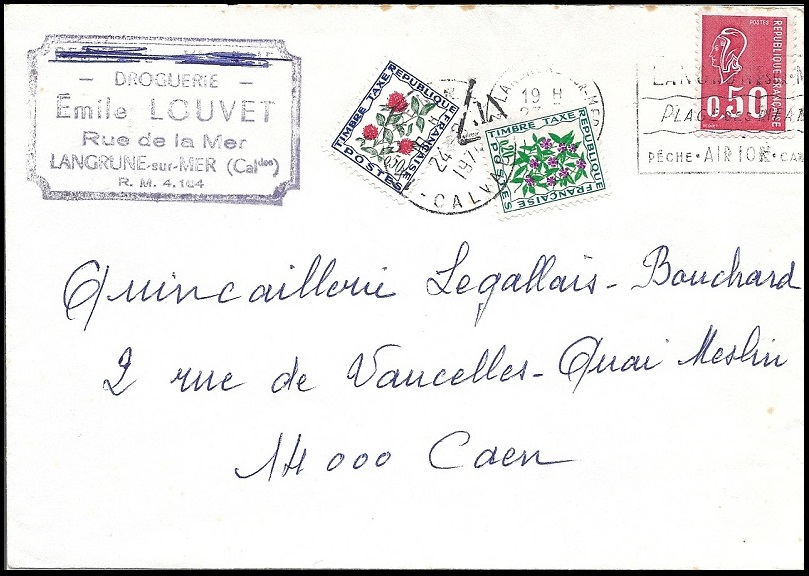

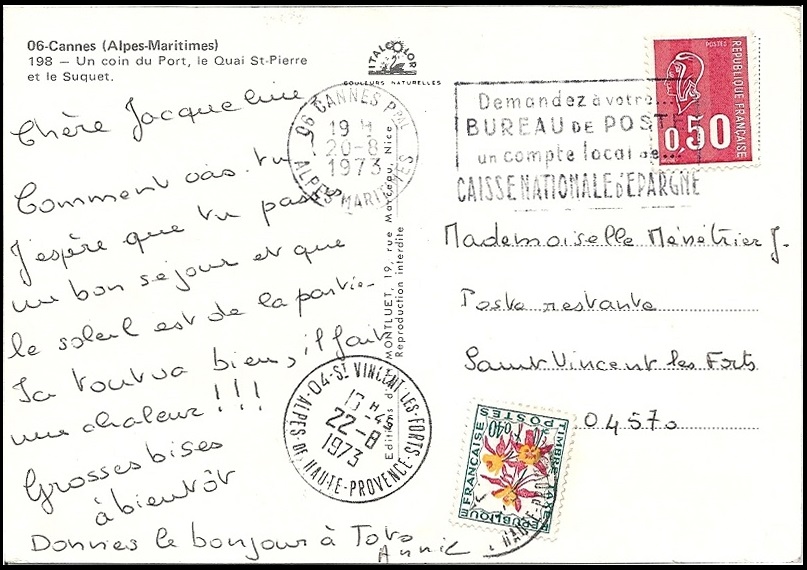

A letter date-stamped 23.09.1974 with a 0,50F stamp. But the rate of an urgent letter has gone to 0,80F on 16.09.1974 and that of a non-urgent letter to 0,60F. 0,10F for a non-urgent letter or 0,30F for an urgent letter is lacking. Thus a tax of 0,70F, which corresponds to the minimum tax at the rate of 16.09.1974, and which is greater than 0,10F x 2 corresponding to the tax calculation.

A letter sent from Réunion Island and stamped with 0,50F, the letter tariff in the first weight step at 4.1.1971. But the letter has a weight between 20 and 25g, thus should be stamped in the second weight step at the rate of 4.1.1971, that is 0,90 F. There is thus an insufficiency of postage of 0,40F. Furthermore, exceeding the weight of 20g, the letter is liable to air taxes at the rate of 0,30F for every extra 5g, so an underpayment of 5 x 0,30F = 1,50F. All in all, 1,90F are thus lacking, thus inducing a tax of 1,90F x 2, or 1,90F CFA francs.

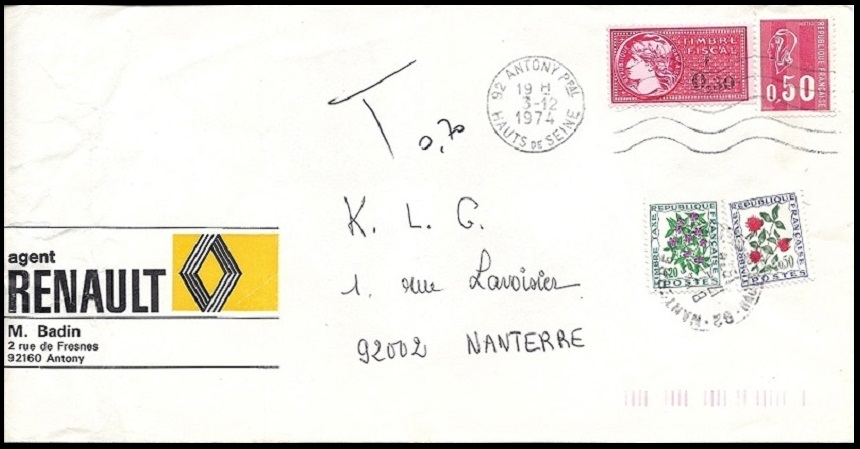

A letter with a 0,50F Marianne de Béquet stamp and a 0,30F revenue stamp. A revenue stamp is a distinctive sign whose purpose is to prove that a tax demanded by a public authority (state, General Council, municipality, …) has been paid. It could involve either a stamped paper or a revenue stamp.

But the payment of the postage stamp for a letter does not belong to taxes demanded by a public authority in the above definition. Hence the taxation of the letter at 0,70F, the minimum tax for the rate of 16.9.1974.

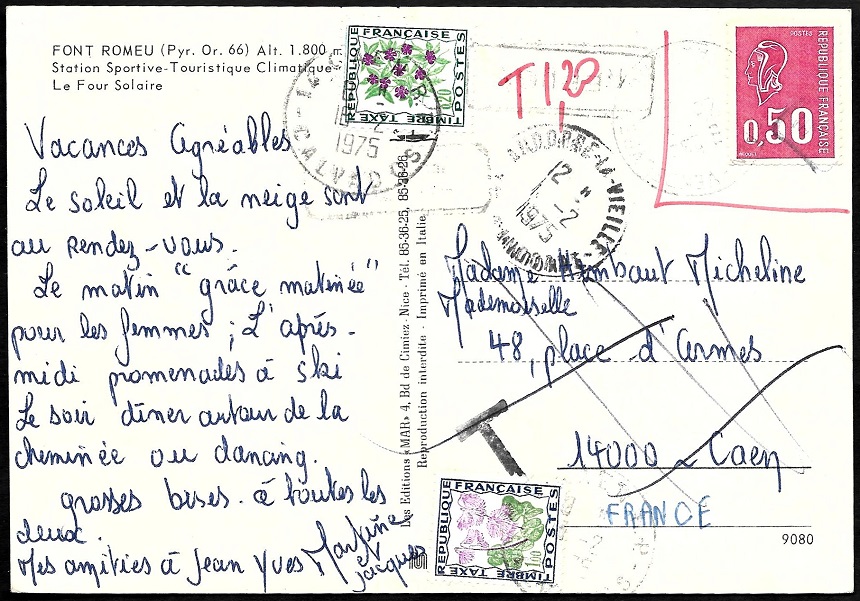

A curious postcard: stamps were cancelled by "tax" marks , and a 3 rd "tax" mark was cancelled. For an erroneous tax?

The special case of pneumatic mail

Since May 1, 1879, private individuals have been able to use the pneumatic network with telegram cards sold by the administration, but it wasn’t until April 1896 that 3 weight bands were created (up to and including 7 g, from 7 to 15 g and from 15 to 30 g), and it wasn’t until August 1, 1898 that envelopes, cards and letter cards from private industry could be used by users, subject to a maximum size of 14.5 x 11 cm. These two new provisions can lead to postage shortages, hence the application of the following two rules laid down in article 6 of the decree of July 11, 1898:

- Pneumatic mail will only be sent via tubes if it bears a minimum postage of 0 fr 30; mail bearing less than this minimum postage will be delivered immediately to the postal service.

– Pneumatic mail with insufficient postage, even though it meets the above minimum, according to the current rates, is sent by tube. They are delivered to the addressee only against payment of the additional postage. If the addressee refuses, they are delivered to the postal service and considered as postal items.

The principle of these provisions remained valid until the abolition of the pneumatic service, with adjustments linked to changes in size and weight categories and changes in routing and taxation rules (minimum postage reduced from 1.50 F to 1 F by article 1 of the decree of February 25, 1931, tax at double the insufficiency since article 3 of the decree of August 6, 1926). Article 6 of the decree of February 22, 1945 stipulates:

- Pneumatic mail will only be sent by tube if it bears a minimum postage equal to half the normal tax. Correspondence bearing less than this minimum postage will be delivered to the postal service. Correspondence with insufficient postage, even if it reaches the above minimum, will nevertheless be forwarded by tube, but will only be delivered to the addressee against payment of double the insufficient postage. If the addressee refuses, they will be handed over to the postal service and treated as ordinary franked letters.

This decree was repealed and replaced by decree no. 60-434 of May 2, 1960, itself replaced by decree no. 62-275 of March 12, 1962, codifying postal and telecommunications regulations.

We will now illustrate the taxation rules specific to pneumatic mail, as described above, with two envelopes featuring Marianne de Béquet at 0.50 F.

The above envelope was posted at Orly airport on 17.8.1974. It should have been franked at 3.90 F, but there are only 2.00 F in postage stamps on the envelope, i.e. more than half the normal tax. The envelope was therefore taxed at twice the rate of the insufficient postage, i.e. 1.90 F x 2 = 3.80 F.

If we look at the back of the envelope, we can see three time stamps dated August 18, 1974, in chronological order: Paris 05, Paris 26 and Paris 18 (recipient distribution office), proving that the envelope did indeed circulate in the pneumatic network.

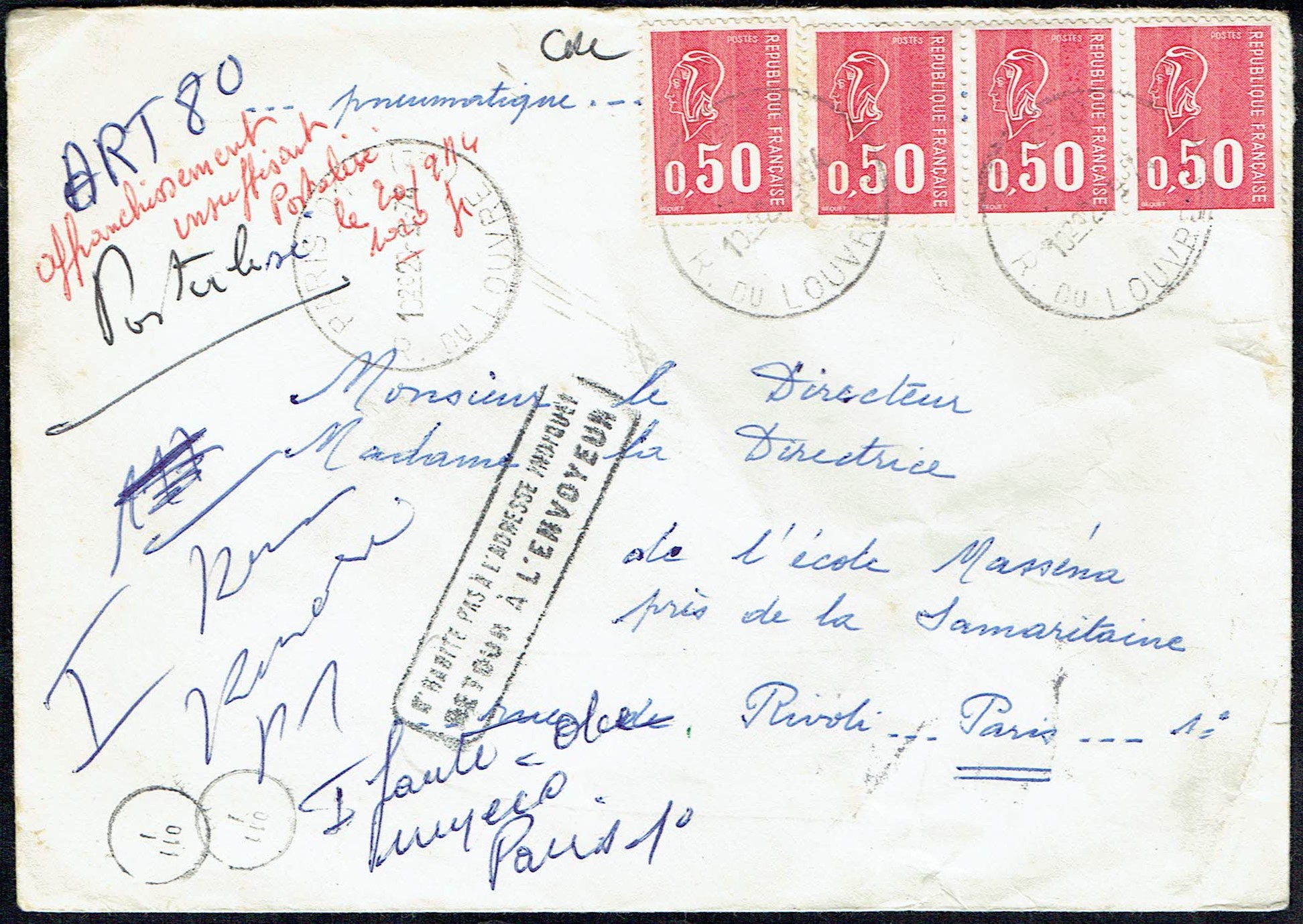

The above envelope was posted to PARIS 01 on 23.9.1974. It should have been franked at 7.00 F, but there are only 2.00 F in postage stamps on the envelope, i.e. less than half the normal tax. The envelope was therefore handed over to the postal service ("postalized" as indicated on the envelope, a term specific to telegraph services), as evidenced by the two ordinary PARIS 01 date stamps on the back of the envelope.

Note: it is interesting to note that the two items reproduced above were mailed one month and ten days apart, with the same postage, but that due to the change in the tariff on September 16, 1974, the treatment of these two items was totally different.

The case of mail sent to foreign countries

The rules for the taxation of international mail have considerably evolved since the 1st Convention on the subject in Bern in 1874. In what follows, I will only recall what is in relation with the period of validity of the Marianne de Béquet and which was defined during the Conventions of Vienna in 1964 (applied from 01.01.1966 to 30.06.1971) and Tokyo in 1969 (applied from 01.07.1971 to 31.12.1975). For more information on this topic , the reader can refer to the book written by G. PRUGNON Taxes et modalités de taxation de la lettre ordinaire dans le régime général international (1876/1975).

Mail not or insufficiently prepaid

Taxation rules in this case are as follows:

- the amount of the fee is twice the amount of the postage shortfall;

- the method for setting the fee is defined as follows: the office of origin of the piece of mail must indicate on the envelope

- the T-mark impression;

- next to the T-mark, an A/B fraction expressed in centimes of French currency, where the numerator indicates double the missing postage and where the denominator provides the amount of tax applicable to the 1st weight scale of letters in the international regime (the general scheme, whatever the destination);

- the tax, in the country of destination, will be calculated by A/B * rate of the letter of the 1st weight scale of the international scheme in the relevant country, rounded up to a maximum of 5 centimes immediately below.

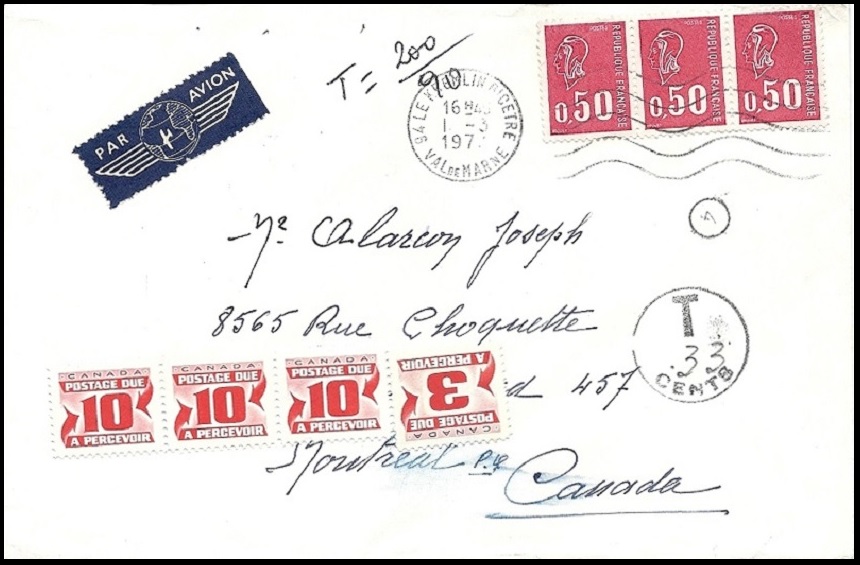

Here are two examples of the application of these rules:

We can see on the above letter the mark "T" (handwritten here) and the fraction A/B. This letter is franked at 1.50F = 0.50F letter rate of 1.8.71 + 2x0.50F air surcharge (Zone G). But this letter must weigh between 15 and 20g and there are therefore two 0.50F air surcharges missing. Hence the value of 200 at the numerator of the fraction and that of 90 at the denominator, tax applicable to the 1st weight scale of letters in the international regime. In Canada, the tax applicable to the 1st international letter weight step is 15 cents, hence a tax of 200/90 * 15 = 33.3, rounded to 33 cents.

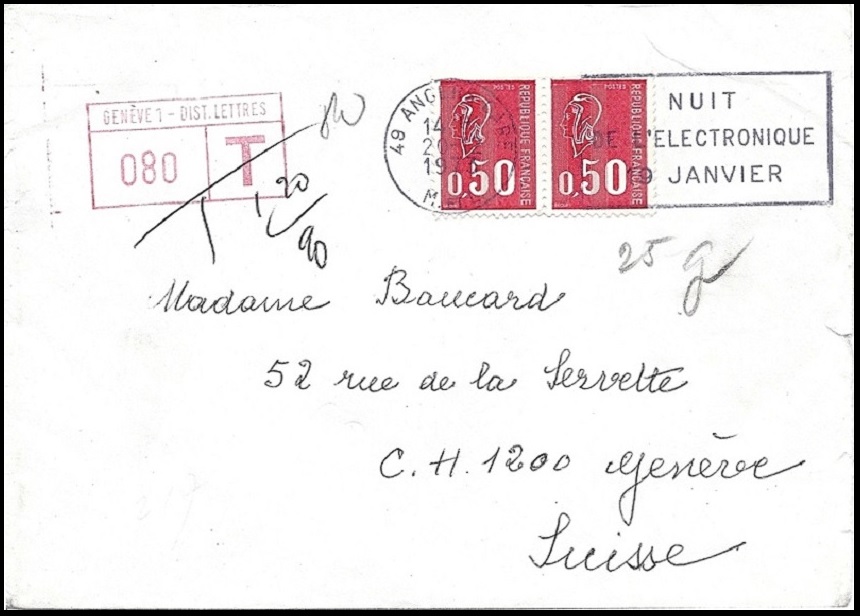

We can see on the above letter the mark "T" (handwritten here) and the fraction A/B. This letter is franked at 1.00F = letter rate of 1.8.71. This letter weighs 25g (pencil mention on the envelope) and the price of a letter of weight between 20 and 50g is 1.60F for Switzerland at the rate of 1.8.71. Hence the value of 120 at the numerator of the fraction and that of 90 at the denominator, tax applicable to the 1st weight scale of letters in the international regime. In Switzerland, the tax applicable to the 1st international letter weight scale is 0.60F, hence a fee of 120/90 * 60 = 80c.

Case of Redirected Mail

Rules concerning the forwarding of a piece of mail have also been changed or amended in the various conventions of the U.G.P. and then of the U.P.U. held since 1874.

As regards to the period of validity of the stamp Marianne de Béquet, it can be noted that when the addressee has entrusted the task of forwarding to a third party, the latter may, if necessary, pay the additional postage (Ottawa Convention 1957).

This is illustrated by the following envelope:

This letter was sent to Romilly from Villeurbanne on 24.7.1971 and franked with a Marianne de Béquet stamp at 0.50F (letter rate of 4.1.1971). The addressee having left for Portugal, a third party forwarded the letter on 30.7.1971 from Romilly, adding a Marianne de Cheffer stamp at 0.30F to obtain the tariff of 0.80F from France for Portugal at the rate of 4.1.1971.

The case of mail coming from foreign countries

The taxation rules are the same as for the mail destined to foreign countries. But there are very few circumstances where folds may include a stamp 0,50F Marianne de Béquet. However, I found two such cases:

- The case of letters posted abroad with a French stamp

We can see in this paragraph various cases of treatment of such covers with a stamp 0,50F Marianne de Béquet. Below, we can see a case where the error was completely detected and treated.

- The case of use of definitive stamps as postage-due stamps

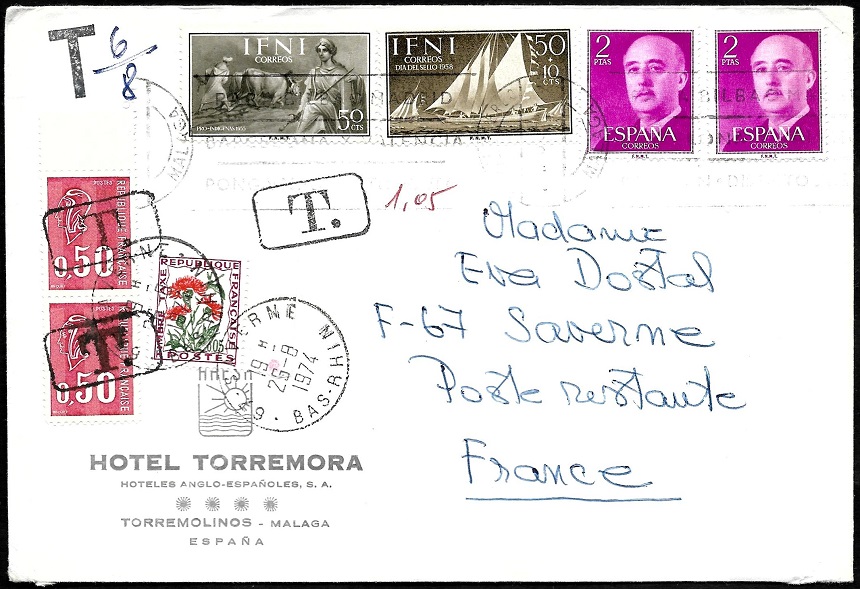

The following letter was posted in Spain and franked with stamps with a value of 5 pesetas. But the price rate of Spain towards France is 8 pesetas by that time, as indicated by the denominator of the fraction written with a pen on the envelope. 3 pesetas are thus missing, hence a 6-pesetas tax, as indicated by the numerator of the fraction. The 6-peseta conversion gives 0,65F. As the letter is sent “Poste Restante”, it is necessary to add a tax of 0,40F, giving a total of 1,05F tax. For some unknown reason (shortage of postage-due stamps?), this sum was realized by a postage-due stamp of 0,05F and 1,00F definitive stamps.

Simple tax

The law of March 29th, 1889 allows some public administrations (pension Armed Forces office, prefectures) to send non stamped letters the addressees of which will have to pay only a simple postage. This simple tax will be deleted January the 1st, 1996, as franking privileges.

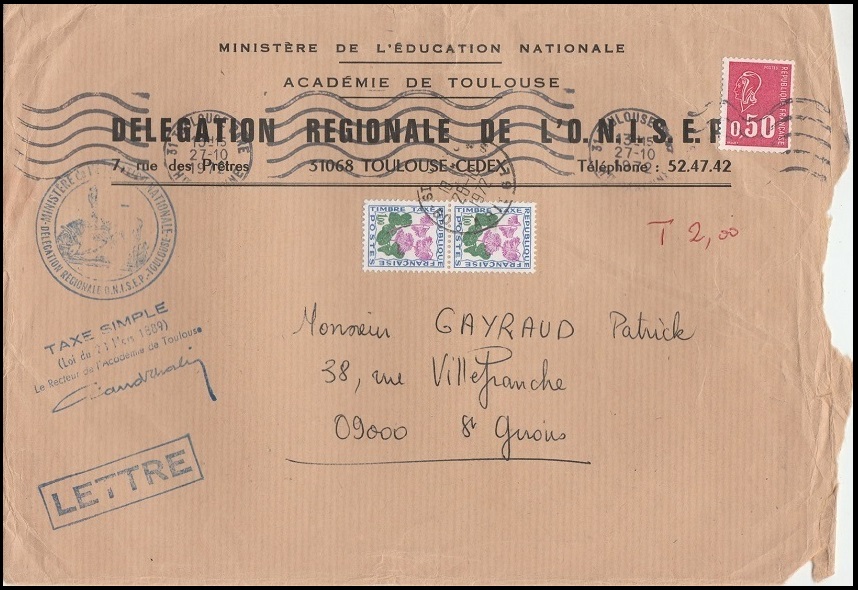

The above letter is not commonplace: this envelope is of the 4th weight step (weight between 100 and 250g). The cost of the postage is thus 2,50F at the price rate of 4.1.1971. As it is a simple tax sending (mark of the vice-chancellor of the academy on the left of the envelope) and as it was franked with a 0,50F stamp, the addressee will only have to pay a 2,00F tax.

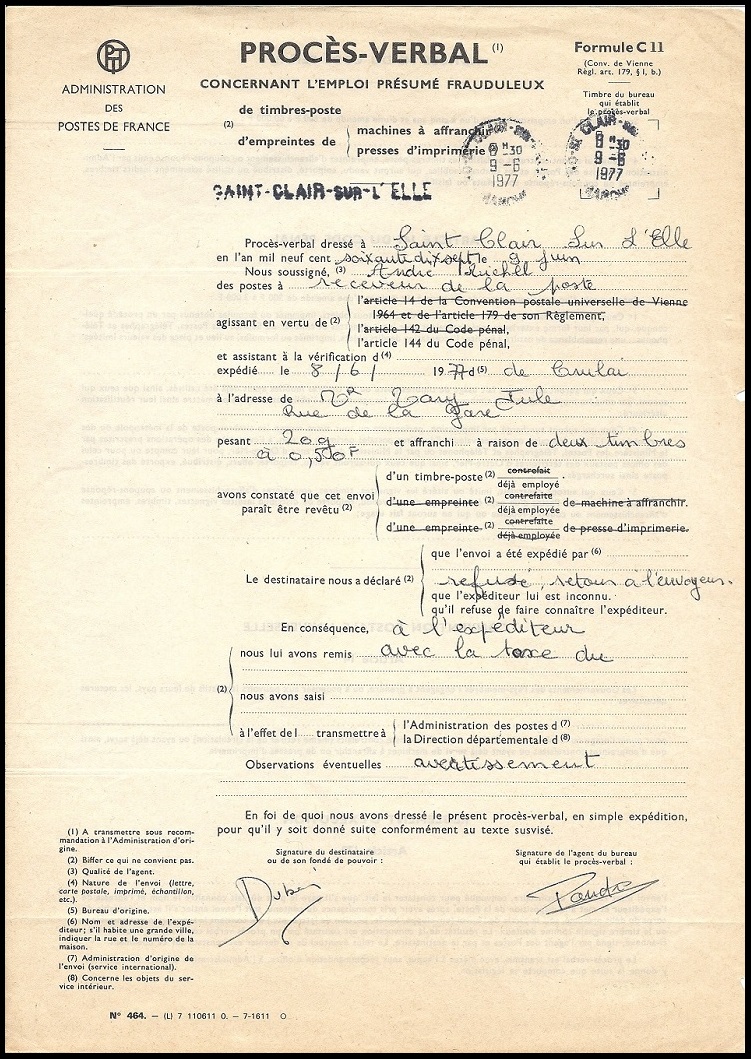

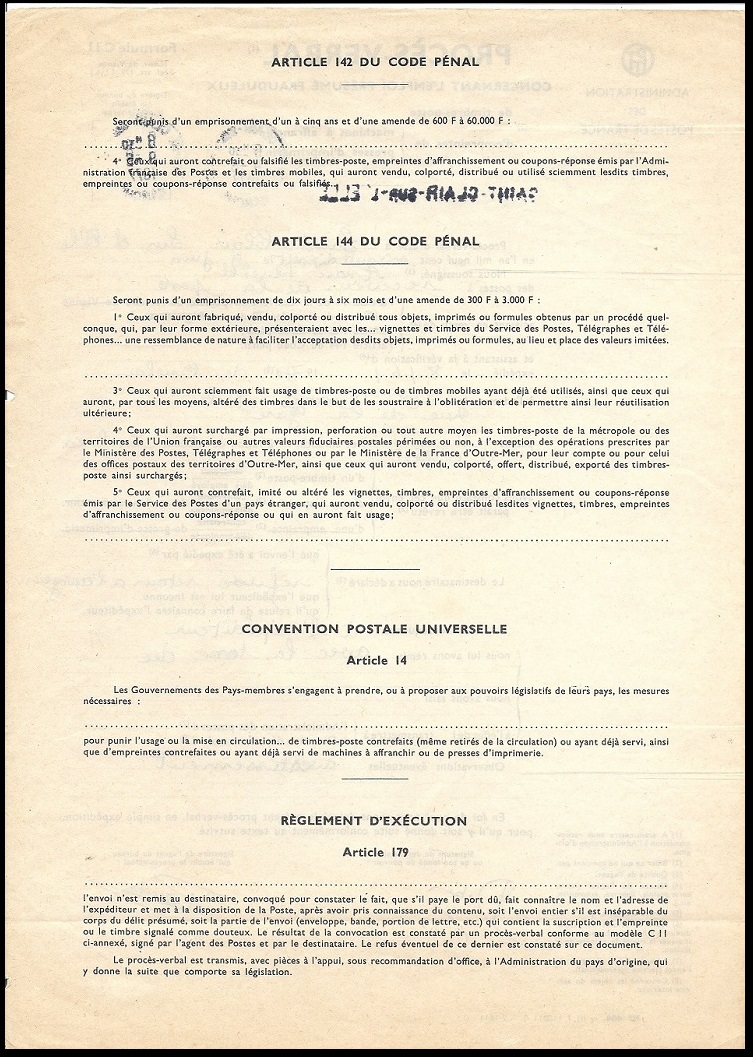

Tickets

A letter with two 0,50F Marianne de Béquet stamps having already been used. This letter was taxed of 1,60F (twice the non urgent letter price at this date) and was the object of a ticket which can be seen below front and back. This ticket corresponds to the law n° 72 437 dated May 30th, 1972, which modified the article 144 of the penal code repressing the re-use of postage stamps. Since this date, because of the slightest gravity of this type of fraud, the legislator decided to "un-refer to correctionnel court" this re-use and to retain it only as an infraction repressed by the first paragraph of the article R.6 of the Code of the PTT.

Tax for justification for a provided service

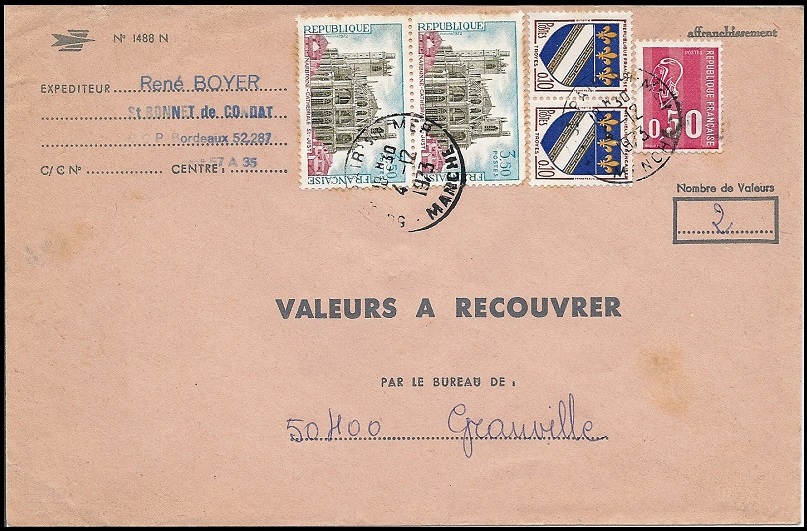

Collection service

Valuable service to be recovered authorized the collection by the department of post offices of receipts, invoices, bills, and more generally all free of charge commercial values payable in France. The price rates of this tax considerably evolved in time. From 1.12.1966, the rights are collected at the departure of mailing by stamps or imprints of franking machines. The tax consists of a right for every postal item, a tax for every value and a postage charge for the postal item. The payment can be made at home by money order or on a Post Office Account. In this last case, the price rate is lower.

Poste restante

Poste restante is the service offered by La Poste by serving as a mailbox. By resuming a part of the order of March 29th, 1920, updated for price lists, here are the rules governing poste restante:

The claiming tax

When a registered or a declared value envelope did not reach its addressee, or is so presumed, the sender may make a complaint at the Post office by means of the form number 846. A tax for this complaint is collected by La Poste whose amount is that of an acknowledgement of receipt requested after the deposit of the envelope.

Customs

Customs can intervene in the case of mail items containing goods, at export or import.

- For export, the user has to affix one green label of customs C1 if the amount of the goods is lower than 550 F (?) or the top of the label C1 otherwise, a customs declaration C2 accompanying the sending.

A registered letter of the 2nd weight level sent to the Netherlands. In the price rate of 1.8.71, it needs a postage of 1,60F + 3F = 4,60F.

- For import, a customs clearance fee is collected by La Poste as soon as fiscal taxes are collected by customs (VAT above some declared value to which are added customs duties for goods with a value greater than some threshold). This tax is generally materialised by tax stamps (or exceptionally by ordinary stamps) stuck on the back of the customs declaration number 260.